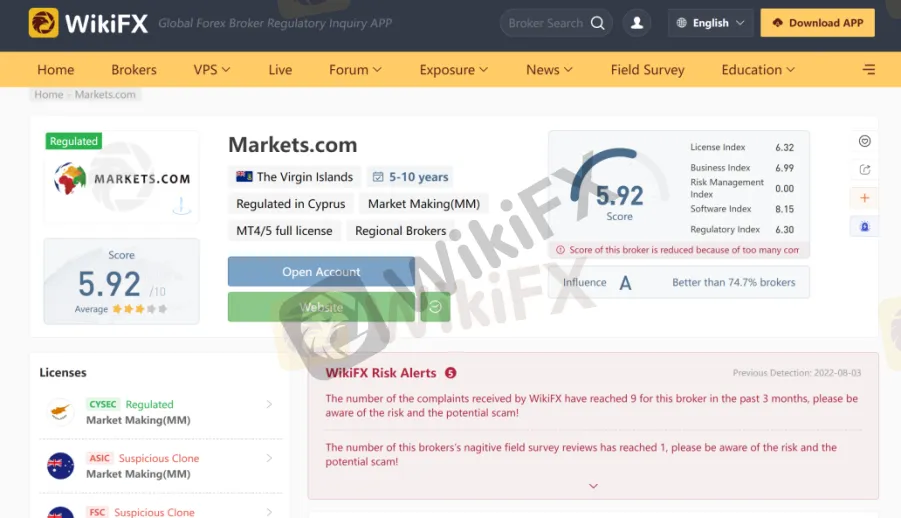

The Australian retail trading landscape couldn’t be more diverse, which makes finding the top forex broker in Australia a hard endeavor. Thankfully, Australia is blessed with a wide range of brokers and a mature industry that caters to a growing base of investors.To get more news about australian forex brokers, you can visit wikifx.com official website.

Australia itself is well known for brokers and retail investing, which is itself a major financial center in the world, spotlighted by the Australian Securities Exchange Ltd (ASX).

We tracked the overall playing field to find the best forex broker in Australia for retail investors. The following synopsis details the top performing Australian forex brokers, highlighted by their respective strengths.

Saxo Markets Australia has an amazing trading platform and a robust educational client portal. The highly trusted, multi-asset broker features over 65,000 tradable instruments and packs some of the best premium features and tools that can take your trading to the next level.

All trading accounts are equipped with margin close-out protection, negative balance protection and 24hr expert customer service. These are some of Saxo Markets Australia's features which further attest to their commitment to creating a safe trading environment.

Saxo Capital Markets holds an Australian Financial Services License (AFSL 280372) and is regulated by the Australian Securities and Investments Commission (ASIC).

The minimum initial deposit at Saxo's is AUD 1000 and by opening an account you can immediately take part in Saxo Bank's loyalty program and earn rewards.

Trading any forex market flexibly is possible as Saxo's features give access to spot FX, crypto, FX option, and FX swaps.

In what concerns leverage, Australian traders can expect to be met with a 50:1 leverage on majors and minor pairs, 40:1 on stock indices, 10:1 on single stocks, and 25:1 on commodities. Spreads are among the most competitive in the industry and start at 0.6 pips on major pairs.

At Saxo, traders can benefit from tier-1 liquidity and price improvement technology. This means they will be able to minimize spreads, achieve near-zero asymmetric slippage, and get the best possible price execution.

Another feature that really shines is that, in stark contrast to other brokers, Saxo has reduced premature stop outs. This means that stop orders are triggered at the opposite end of their respective spreads as a way of preventing traders from getting stopped out prematurely.

With a seamless trading experience, full transparency, an award-winning trading platform, and best-in-class execution, Saxo Bank is certainly a top contender for the best forex broker in Australia.

IG is a widely known name across the forex market. This brokerage offers exceptional trading tools, unparalleled educational resources, and incredibly designed proprietary trading platforms.

Australian traders who sign up with IG can expect to be met with a wide variety of trading products and two different account types:

CFD account: in which traders are required to pay a commission on whichever share CFD transactions they make while other assets are kept traded commission-free. Spreads are variable, starting at 0.6 pips and IG can occasionally act as a market maker on trades.

DMA account (also known as a level 2 trading account): with tighter spreads starting at 0.1 pips but also a commission which is based on the size of the trade. DMA accounts are only available via iOS IG trading platforms and the L2 dealer. It is the preferred account type of pro traders given that it offers what can possibly be one the best execution environments (trading straight through the exchange order books).

Both trading account types require a $450 minimum deposit and can be funded via Mastercard, Visa, Paypal, or bank transfer.

Australian retail traders can leverage their positions 30:1 on major pairs and 20:1 on minor pairs, whereas professional forex traders can reach 100:1 and 250:1 leverage, respectively.

IG features 100 forex pairs, over 80 indices, over 13000 stocks, 12 cryptocurrencies, over 2000 ETFs, over 13000 options, and many commodities at the ready.

In terms of customer support, IG can be reached 24hrs a day, 6 days a week. IG is also fully regulated by the Australian Securities and Investments Commission (ASIC) and is a holder of an Australian Financial Services (AFS) License.