Interest charges for freelancer loans can differ extensively relying on the lender and the borrower's financial profile.

Interest charges for freelancer loans can differ extensively relying on the lender and the borrower's financial profile. While some freelancers might encounter greater rates as a result of perceived risk, others with steady earnings and good credit score might discover aggressive charges similar to traditional loans. It’s essential to buy round and compare provi

To decide if an extra loan fits your monetary wants, assess your present financial state of affairs, borrowing objective, and repayment capacity. Consider rates of interest, mortgage terms, and potential fees associated with borrowing. Consulting with a monetary advisor may also be helpful for customized steer

Lastly, think about in search of skilled monetary recommendation. Financial advisors can assist borrowers in formulating a plan to resolve delinquent loans while additionally fostering higher financial habits and a sustainable price range for the long

n Several elements can impression your credit mortgage approval, together with your credit score rating, income level, employment standing, and existing debts. Lenders primarily evaluate these standards to discover out your threat stage. A excessive credit score and stable revenue typically improve your probabilities of being appro

What is a Freelancer Loan?

A Freelancer Loan is a kind of financing designed particularly for independent contractors and self-employed individuals. Unlike conventional loans that always require a steady paycheck, freelancer loans bear in mind the unique financial state of affairs of those that could expertise fluctuating earnings ranges. This flexibility is crucial for freelancers who may have various workloads and revenue streams throughout the year. Knowing these loans exist allows freelancers to access funds when needed, whether or not for unexpected bills, business growth, or private ne

Learning tips on how to interpret credit score reports also plays a crucial function in avoiding delinquencies. Understanding the factors that contribute to credit score scores permits borrowers to make knowledgeable selections regarding their financial cond

When applying for a freelancer loan, you usually need to provide proof of earnings, such as bank statements, invoices, and contracts with clients. Some lenders may also require your credit score rating and monetary statements. Ensuring you have these documents ready can streamline the appliance process significan

Costs and Considerations

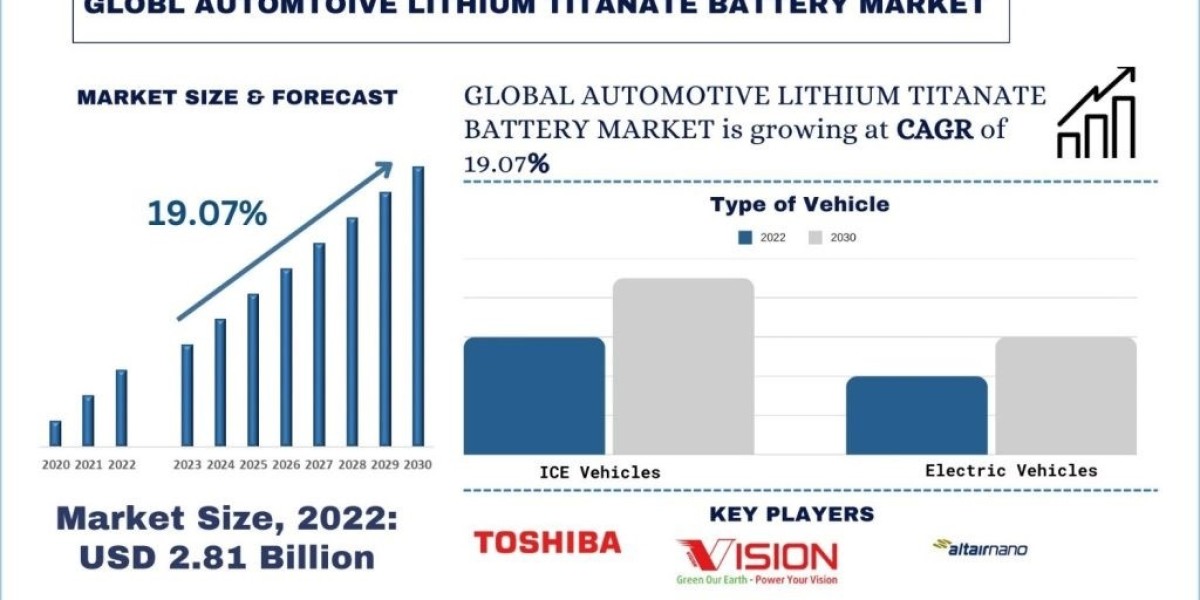

While there are evident advantages to acquiring additional loans, borrowers should additionally consider the associated prices. Interest rates can range significantly based on credit scores, the type of loan, and prevailing market circumstances. It is essential to conduct comparative analyses to safe the absolute best char

Once you've your paperwork in order, you presumably can initiate the application course of, either on-line or in particular person. During this section, be prepared for a credit verify, which will influence your credit rating quickly. After submitting your software, lenders will review your info, and if permitted, you'll obtain

Loan for Office Workers particulars that define the interest rate, reimbursement schedule, and any fees invol

Utilizing Loans Responsibly

For freelancers, responsibly utilizing loans is crucial for long-term success. This means borrowing only what is important and guaranteeing that repayment is manageable. Creating a transparent financial plan that includes projected earnings and bills can guide freelancers in determining

redirected here how a lot they can afford to bor

On the opposite hand, variable interest rates can change based on financial circumstances, probably increasing your complete compensation quantity. Therefore, it's essential to understand how rates of interest have an effect on your loan and to shop around for the most effective presents before making a decis

Another challenge is discovering lenders who specifically cater to freelancers. Many conventional banks could not fully understand the nuances concerned in freelance work, leading to potential misunderstandings or misaligned lending methods. Researching on-line lending platforms that focus on the freelance neighborhood can present better-suited options for loan seek

Benefits of Freelancer Loans

Freelancer loans include quite a few advantages that specifically cater to the needs of self-employed people. One of the first advantages is the flexibility in compensation phrases. Many lenders perceive the financial realities of freelancing and provide extra handy reimbursement options to accommodate the variable earnings patterns of these employ

Understanding credit score loans is important for making informed financial decisions. By leveraging resources like Bepick, you can arm your self with the information necessary to navigate this complex landscape successfully. Doing so will empower you to choose the proper credit score mortgage for your needs whereas guaranteeing responsible financial management along the way in wh

FOR THAILAND CITIZENS - United States United States of America - ESTA Visa - Immigration Office for USA Visa Online - ศู

By visaonline

FOR THAILAND CITIZENS - United States United States of America - ESTA Visa - Immigration Office for USA Visa Online - ศู

By visaonlineEnergy-Efficient Appliance Repair Tips for Mansfield Homes

By ellie480 Water Flosser Market Research Insights: Informing Business Decisions and Strategies

Water Flosser Market Research Insights: Informing Business Decisions and Strategies

Then Again

Then Again

Professional Cleaning Services | Top Cleaning Companies in Dubai

By kingseo

Professional Cleaning Services | Top Cleaning Companies in Dubai

By kingseo