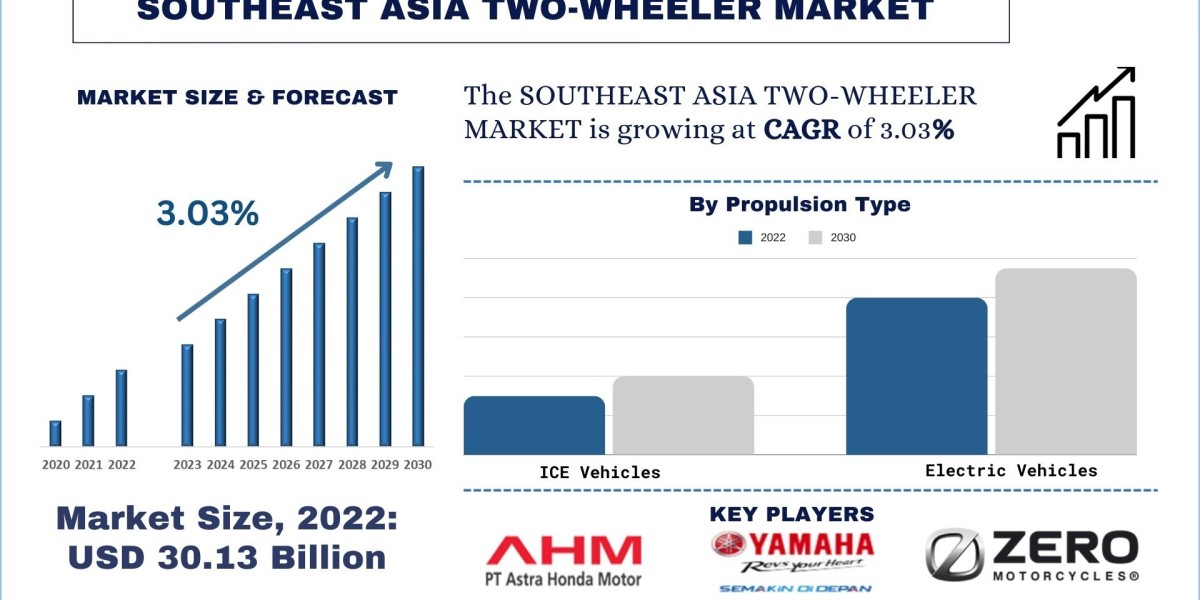

According to a new report by Univdatos Market Insights, the Southeast Asia Two-Wheeler Market is expected to reach USD 37.13 billion by 2030, growing at a CAGR of 3.03%. This growth can be attributed to the increasing urbanization and rising demand for affordable transportation options in the region. The market includes both internal combustion engine (ICE) two-wheelers and electric two-wheelers, with a noticeable shift towards the adoption of electric vehicles.

"INCREASING URBANIZATION AND RISING DISPOSABLE INCOMES"

The rapid urbanization in Southeast Asia has resulted in increased congestion and traffic congestion in cities. As a result, there is a growing demand for efficient and convenient transportation options. Two-wheelers, including motorcycles and scooters, have become a popular choice among urban residents due to their affordability, ease of use, and ability to navigate through traffic. Rising disposable incomes in the region have also contributed to the growing demand for two-wheelers, as more individuals can afford to purchase and maintain these vehicles.

Request Free Sample Pages with Graphs and Figures Here - https://univdatos.com/get-a-free-sample-form-php/?product_id=57081

"SHIFT TOWARDS ELECTRIC TWO-WHEELERS"

With an increasing focus on sustainability and reducing carbon emissions, there is a noticeable shift towards the adoption of electric two-wheelers in Southeast Asia. Governments in the region are implementing policies and initiatives to promote the use of electric vehicles, including subsidies and incentives for manufacturers and consumers. For example, countries like Thailand and Indonesia have introduced tax incentives and subsidies for electric vehicle manufacturers and buyers. This shift towards electric two-wheelers is driven by the need to reduce pollution and dependence on fossil fuels, as well as the lower operating costs and maintenance requirements of electric vehicles. Additionally, Southeast Asia (SEA) is home to four of the most prominent motorcycle markets globally: Indonesia, Vietnam, Thailand, and Malaysia. Collectively, these countries possess over 200 million motorbikes, a figure that matches the number found in India, the largest motorcycle market worldwide. The sales of electric two-wheelers currently represent approximately one percent of new two-wheeler sales in Indonesia, Thailand, and Vietnam. However, forecasts indicate a significant increase in sales, with a compound annual growth rate (CAGR) exceeding 50% soon. This growth is expected to be driven by government incentives, enhancements in infrastructure, and changes in consumer preferences.

“FORWARD THINKING POLICY”

In South-East Asia, the United Nations Environment Programme (UNEP) collaborates with governments to enhance policy frameworks and has initiated various pilot projects to showcase the feasibility of electric vehicle infrastructure.

In the Philippines, UNEP partnered with Clean Air Asia, the Philippine Postal Corporation, the City of Pasig, and electric vehicle manufacturer TAILG to demonstrate the capabilities of electric two- and three-wheelers for urban freight transportation. These vehicles were utilized to distribute essential relief supplies during lockdowns amid the pandemic.

Meanwhile, in Viet Nam, UNEP is engaged in a similar initiative with the University of Transport Technology. For instance, Honda Vietnam contributed 50 electric scooters to the project in March 2019 to help identify obstacles related to policy and regulations hindering the adoption of electric vehicles.

Furthermore, UNEP is involved in a comprehensive global program that promotes electric mobility in urban areas across South-East Asia and East Africa. This initiative, in collaboration with Germany’s Federal Ministry of the Environment, Nature Conservation, and Nuclear Safety (BMU) International Climate Initiative, focuses on integrating electric vehicles into mainstream transportation. Activities include research studies on gas-powered motorized two- and three-wheelers' numbers, fuel efficiency, electricity grid analysis, and electric vehicle demand projections.

Fabian emphasized the importance of proactive policymaking to keep pace with the increasing sales of two-wheelers and to effectively promote and regulate electric vehicles. UNEP's efforts on motorcycles and three-wheelers align with the Global Fuel Economy Initiative's objectives to reduce CO2 emissions from these vehicles by 80% by 2035 and 95% by 2050. UNEP, a founding partner of GFEI, has broadened its scope from cars to encompass all on-road vehicles, including trucks, buses, and motorcycles. GFEI's endeavors are supported by the FIA Foundation, the GEF, the European Commission, the Hewlett Foundation, and others.

Related Reports-

Smart E-Drive Market: Current Analysis and Forecast (2023-2030)

Hydrogen Powered Tractor Market: Current Analysis and Forecast (2023-2030)

Electronic Park Lock Actuator (EPLA) Market: Current Analysis and Forecast (2023-2030)

Flying Car Market: Current Analysis and Forecast (2023-2030)

EVTOL Market: Current Analysis and Forecast (2023-2030)

"LATEST INSTANCES"

· In November 2023, Honda Motors announced that the company will be investing USD 3.3 billion to sell 4 million electric motorcycles by 2030. The company will invest on R&D and launch new models in the Asia market.

· In September 2022, Gogoro Inc., announced the launch of its industry-leading battery swapping system and Smart scooters.

· In 2021, Indonesia's ride-hailing company, Gojek, announced plans to expand its fleet of electric motorcycles in the country. The company aims to have 2,000 electric motorcycles in its fleet by the end of the year, as part of its commitment to a more sustainable and environmentally friendly transportation system.

· In March 2022, Honda unveiled its first electric scooter, the Honda e: STORM, in Vietnam. The electric scooter is targeted towards urban riders and offers a range of up to 80 kilometers on a single charge. This launch highlights Honda's commitment to the electric two-wheeler market in Southeast Asia.

· Gojek aims to replace all its two-wheelers with e-motorbikes by 2030. The company reportedly has more than 2 million registered drivers of motorbikes and automobiles. This plan is expected to significantly contribute to the Indonesian government's goal of having 9 million electric motorcycles on the road by 2030.

· In Thailand, the government has introduced a pilot program for electric motorcycles, providing subsidies for the purchase of electric two-wheelers and charging infrastructure development. This program aims to encourage the adoption of electric vehicles and reduce carbon emissions in the country.

Request for TOC, Research Methodology & Insights Reports - https://univdatos.com/report/southeast-asia-two-wheeler-market/

“CONCLUSION”

The Southeast Asia two-wheeler market, encompassing both ICE and electric two-wheelers, is experiencing significant growth due to increasing urbanization, rising disposable incomes, and a shift towards sustainable transportation options. The market presents lucrative opportunities for manufacturers and investors, especially in the electric vehicle segment. As governments in the region continue to support and promote the adoption of electric vehicles, the market is expected to witness further growth in the coming years. Manufacturers and stakeholders are advised to capitalize on this growing market by developing innovative and sustainable two-wheeler solutions that cater to the evolving needs and preferences of Southeast Asian consumers.

Contact Us:

UnivDatos Market Insights

Email - [email protected]

Contact Number - +1 9782263411

Website - www.univdatos.com