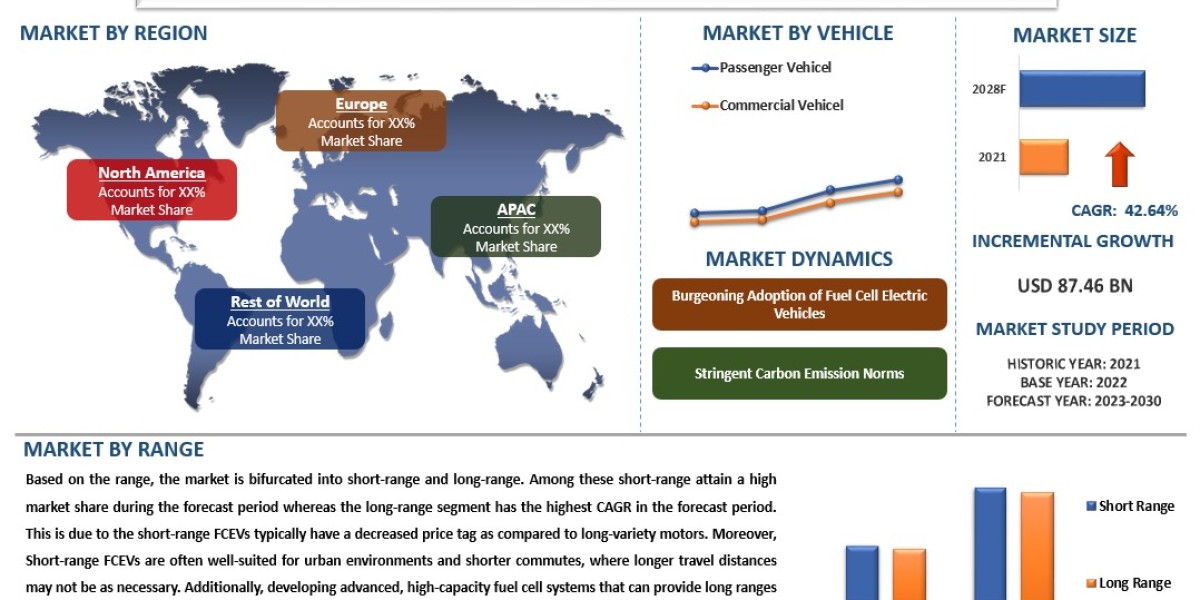

According to a new report published by UnivDatos Markets Insights, The Hydrogen Fuel Cell Electric Vehicle Market was valued at USD 5.42 billion in 2022 & is expected to grow at a CAGR of 42.64% from 2023-2030. The analysis has been segmented into Vehicle Type (Passenger Vehicle, Commercial Vehicle), Type (Proton Exchange Membrane, Solid Oxide Fuel Cell, and Phosphoric Acid Fuel Cell), Range Short Range and Long Range), Region/Country.

The hydrogen fuel cell electric vehicle market report has been aggregated by collecting informative data on various dynamics such as market drivers, restraints, and opportunities. This innovative report makes use of several analyses to get a closer outlook on the ride Sharing market. The ride Sharing market report offers a detailed analysis of the latest industry developments and trending factors in the market that are influencing the market growth. Furthermore, this statistical market research repository examines and estimates the ride Sharing market at the global and regional levels.

Request for Sample Pages - https://univdatos.com/get-a-free-sample-form-php/?product_id=44785

Key Market Opportunities

The hydrogen infrastructure development presents several opportunities for the fuel cell electric vehicle (FCEV) market.

Improved Refueling Infrastructure: The expansion of hydrogen refueling stations provides FCEV owners with more convenient access to fuel. This infrastructure increase encourages consumer self-belief in FCEVs with the aid of alleviating issues approximately range anxiety. countries like Japan, Germany, and South Korea have made significant investments in constructing hydrogen refueling infrastructure, promoting FCEV adoption.

Extended Driving Range: Unlike battery-electric automobiles (BEVs) that require longer recharging times, FCEVs can be refueled within a couple of minutes, imparting a similar comfort to conventional fossil fuel-powered automobiles, via making an investment in hydrogen infrastructure. The driving variety of FCEVs can be considerably extended, encouraging consumers who generally require long-range capabilities to consider this technology.

Scalability and Cost Reduction: Through the development of hydrogen infrastructure, economies of scale can be achieved in the production and distribution of hydrogen fuel. As hydrogen becomes more readily available, its cost per kilogram can potentially decrease, making FCEVs a more economically viable option for consumers.

For instance, In September 2022, The U.S. Department of Energy today opened applications for the USD 7 billion programs to create regional clean hydrogen hubs (H2Hubs) across the country, which will form a critical arm of America's future clean energy economy.

The “Hydrogen Deployment Plan for the Energy Transition” of France defined The target of 5000 light commercial vehicles and 200 heavy-duty ones and the construction of 100 stations supplied with locally produced hydrogen by 2023.

Hydrogen infrastructure development creates opportunities for the FCEV market by improving refueling accessibility, extending driving range, reducing costs, integrating clean energy, and diversifying transportation fuel options.

COVID-19 Impact

The COVID-19 pandemic has had a sizable impact on various industries worldwide, which include the fuel cell electric automobile (FCEV) market. The demand for FCEVs, which depend upon hydrogen fuel cells for power, has been laid low with numerous factors, ranging from disruptions in the supply chain to changes in consumer behavior. One of the key challenges faced by the FCEV market through the pandemic become disruptions within the global supply chain. As lockdown measures have been implemented throughout different countries, production facilities have been pressured to shut down or operate at reduced capacities. This led to delays and shortages of critical components required for FCEV production, along with hydrogen fuel cells and hydrogen storage tanks. for instance, in early 2020, Toyota, a leading FCEV manufacturer, faced production slowdowns due to supply chain disruptions due to the pandemic. Furthermore, the COVID-19 outbreak led to a significant decline in consumer demand for automobiles globally. As people have been compelled to live at home and travel restrictions were put in the area, the overall automobile industry experienced a slowdown. This affected the FCEV market as well, with potential buyers being hesitant to invest in new automobiles for the duration of uncertain instances. for instance, in 2020, the global sales of FCEVs had been seriously impacted, with a tremendous decline as compared to the previous year.

Segmentation Details:

· By vehicle type, the market is segmented into passenger vehicles and commercial vehicles. Among these, the passenger segment held the highest market share in the market in 2022.

· By type, the market is categorized into polymer electrolyte membrane (PEM), phosphoric acid fuel cell, and solid oxide fuel cell. Among these, the polymer electrolyte membrane (PEM) segment held a significant share of the market in 2022.

· Based on the range, the market is categorized into short-range and long-range. Among these short-range attain a high market share in 2022, and during the forecast period whereas the long-range segment has the highest CAGR in the forecast period.

Related Reports-

Ride-Sharing Market: Current Analysis and Forecast (2022-2028)

Automotive Steel Wheels Market: Current Analysis and Forecast (2022-2030)

Automotive Secondary Wiring Harness Market: Current Analysis and Forecast (2022-2028)

Car Bike Rack Market: Current Analysis and Forecast (2022-2030

In Wheel Motor Market: Current Analysis and Forecast (2023-2030)

Electric Vehicle Brake Pads Market: Current Analysis and Forecast (2023-2030)

Terminal Tractor Market: Current Analysis and Forecast (2023-2030)

Automotive Power Steering Motor Market Geographical Segmentation Includes:

· North America (U.S., Canada)

· Europe (Germany, Netherlands, UK, France, Switzerland, and Rest of Europe)

· Asia-Pacific (China, Japan, South Korea, and the Rest of Asia-Pacific)

· Rest of the World

The Asia Pacific region is projected to dominate the forecast period as the region has the highest number of automotive manufacturers and production units that cater to the demand for hydrogen fuel cell electric vehicles. The foremost factors attributed to the boom of the market are the increasing favorable government policies, technological advancements, investment by governments and private players, and economic growth. Further on, the region is the world's biggest automobile market, and governments in many countries, including China, Japan, and South Korea, have been actively promoting the adoption of fuel-cell electric vehicles to reduce pollution and carbon emissions by providing rebates on cars and trucks. For instance, in 2023, in South Korea, the purchase of a new passenger car will qualify for government support of 22.5m won ($18,000) with some states adding local subsidies on top — Busan and Incheon are each offering top-ups of up to 33.5m won ($27,500), and purchased trucks and buses qualify for 21m-26m won ($17,000-$21,000) of subsidies and garbage trucks for 72m won ($59,000. Therefore, the persistent government support from countries to make FCEVs affordable and easily accessible to consumers is catering to the demand for fuel-cell electric vehicles in the region. As China continues to invest in the development of hydrogen refueling stations and fuel cell technology, the adoption and production of FCEVs will continue to rise in the years to come. Moreover, the Chinese government also provides incentives and rebates on fuel-cell electric vehicles for mass adoption. For instance, the government provides a purchase subsidy of up to USD 4500 on FCEVs, an exemption from tax, and vehicle registration tax. Moreover, The Japanese government strongly supports FCEV development and adoption. They offer incentives like subsidies and tax breaks to incentivize consumers to purchase FCEVs. Furthermore, they've made significant investments in hydrogen infrastructure, including refueling stations, to tackle the limited refueling options challenge. For instance, in June 2023, the Japanese government announced a new investment plan of USD 107 billion over the next 15 years to support the development and deployment of FCEVs. Moreover, the Japanese government provides subsidies of up to USD 27000 depending upon the model for the purchase of FCEVs. Therefore, the surging adoption of electric vehicles geared the demand for hydrogen fuel cell electric vehicles. Therefore, the surging adoption of electric vehicles geared the demand for hydrogen fuel cell electric vehicles.

Competitive Landscape

The degree of competition among prominent global companies has been elaborated by analyzing several leading key players operating worldwide. The specialist team of research analysts sheds light on various traits such as global market competition, market share, most recent industry advancements, innovative product launches, partnerships, mergers, or acquisitions by leading companies in the ride Sharing market. The major players have been analyzed by using research methodologies such as Porter’s Five Forces Analysis for getting insight views on global competition.

Recent Developments:

· In 2022: Toyota Motor Corporation announced a partnership with BMW to develop and produce fuel-cell electric vehicles. The partnership is expected to help the two companies reduce the cost of FCEV and accelerate their commercialization.

· In May 2023: Hyundai Motor Company premiered its new XCIENT Fuel Cell tractor, the commercialized class 8 6x4 fuel cell electric model, for the North American commercial vehicle market at the Advance Clean Transportation Expo.

· In September 2022: Hyundai and IVECO presented the first IVECO e-daily Fuel Cell Electric Vehicle, a fuel cell van developed in collaboration with IVECO Group.

· In July 2020: Hyundai launched the XCIENT Fuel Cell heavy-duty truck, which is the world’s first mass-produced fuel truck.

Key questions resolved through this analytical market research report include:

• What are the latest trends, new patterns, and technological advancements in the hydrogen fuel cell electric vehicle market?

• Which factors are influencing the ride Sharing market over the forecast period?

• What are the global challenges, threats, and risks in the hydrogen fuel cell electric vehicle market?

• Which factors are propelling and restraining the hydrogen fuel cell electric vehicle market?

• What are the demanding global regions of the hydrogen fuel cell electric vehicle market?

• What will be the global market size in the upcoming years?

• What are the crucial market acquisition strategies and policies applied by global companies?

• What are the descriptive profiles of key companies along with their SWOT analysis?

We understand the requirement of different businesses, regions, and countries, we offer customized reports as per your requirements of business nature and geography. Please let us know If you have any custom needs.